Tuesday, December 30, 2008

American Express Blue Cash Back Credit Card

+No Annual fee

+Up to 5% cashback on everyday purchases and 1.5% on everything else (see details below)

+0% interest on first 12 months of purchases (don't plan on taking advantage of this)

+Earn unlimited rewards

+Purchase Protection

+Extended Warranty

Blue Cash from American Express has 1 percent cash back on everyday purchases until you spend $6,500. After that, your rebate jumps to 5 percent cash back. On other purchases, 0.5 percent cash back goes up to 1.5 percent cash back. There are no cap limits on your purchases over the year. You can only get your cash back once every year and it they will only give you the cash back in the form of statement credit. The nice part is they put the credit on your account automatically after your year of use. No call, no worries.

Monday, December 29, 2008

Don't Forget Your Auto Loan - Refinance?

Sunday, December 28, 2008

Find Real Bargains on Tech Items at Techbargains

So, if you are looking for any tech gear check out Techbargains.

Christmas Giveways! Two Free Ipods

Wednesday, December 24, 2008

Credit Unions - Better than Banks

My solution that I have been using for the last 20 years is to use a credit union. Their accounts are always consumer friendly. No minimum on interest checking accounts. No minimum on savings accounts. Good rates and services. The offer online account access, free check images and free online bill payment. I get my car loans through them and they lower the rate 1/2% if you let them take it out of your checking account. That's a win-win since I don't have to write a check and that is where the money was going to come from anyway. And if you have read any of my posts, I like automatic payment methods.

Setup Your Automatic Savings Plans

Fund Your 401K Then Up the Amount

Organize Your Checking Accounts to Better Manage Your Money

I found one credit union through my employer and the other is in the community. I'm sure you can find one easily. Ask a co-worker, your HR department or a neighbor. I won't go back to a bank anytime soon.

Monday, December 22, 2008

ING Direct - A Great Place for your Savings

Oh, by the way, the INGdirect Orange Savings account is FDIC insured.

Check out my write up Squidoo.

Sunday, December 21, 2008

Watch Mortgage Rates - Options If They Go Lower

So, let's think about it. Inflation over the years has averaged about 3.42%. Stocks have averaged about 8%. Five year CD rates have averaged about 4%. US Treasuries have averaged about 5.5% for 20 year notes. Now let's imagine that mortgage rates drop to 4.5%. You can now borrow money for your house that is only about 1% more than the historical inflation rate. In the future years you will paying your mortgage with dollars that are worth less than you paid to borrow them. Or to look at it another way, you could take out $100,000 in equity on your house and put that money in a 20 year US Treasure (in a few years assuming rates return to more normal levels) and pay your mortgage while you earn an additional 1%. Or you could put it in the stock market and you should be able to earn the average 8% over the next 20 years to pay your mortgage and earn 3.5% every year. None of this takes into account the deduction you will receive on your taxes which will lower the effective rate to at least 4% depending on your tax bracket. This could give us an opportunity to acquire capital at rates not seen for quite some time.

Now with this all said, I'm only a few years away from paying off my mortgage and my current plan is to just pay it off. But these historical rates make you think.

Saturday, December 20, 2008

Time to Refinance Your Mortgage?

I don't recommend adding any other loans to your mortgage unless they are house related. So, if you had a second mortgage or you got a home equity loan to increase the value of your home then I would roll that into your mortgage. I don't recommend adding your car loan or credit card debt to your mortgage. First of all, if you have been reading my blog you know I don't believe you should ever carry a balance on your credit card. You shouldn't add your car loan to your mortgage because you are just going to pay interest on your car for another 20 years instead of 3 or 4 years. That will add up to a lot of interest over the years. You should consider refinancing your car loan if you want to do something about your car. Now if you got yourself into a situation where you do have credit card debt or have other financial problems then you can consider adding it to your refinance amount but you can't, I repeat CAN'T, allow yourself to get back in debt on your credit cards in the future.

Friday, December 19, 2008

Year end Financial Tasks

Before the year ends there are few things to do to close out this year and begin next year. First find your most recent paycheck. Use that to figure out how much you will make, how much was taken out in taxes and how much you invested in your 401K. If you have some money you saved to cover your expenses for the rest of the year, contact your payroll department and have them increase your 401K contribution for the last paycheck of the year. You can change that amount every paycheck if you want. Now take the totals from your paycheck and do a quick calculation on how your taxes may come out. If you didn't contribute enough, contact payroll and have them take out more on that last check so you don't have a big tax bill in April. If you have contributed too much have payroll lower your tax deduction on your last check. No sense in waiting until next year to get your hands on that money. I use Turbotax to calculate my taxes. I usually just take last years version and input this years nunbers to get a rough estimate. Also, you can just use the free online version to do this quick calculation.

Now, think about any other year end tasks, like paying personal property tax to the state or estimated taxes if your self employed. Have you made your charitable contributions? If not, now would be a good time to do it. And since you just did a quick tax calculation would a bigger contribution knock you down a tax bracket. If you are self employed you should have some type of IRA. Make a contribution to that before the year is over. Some of the IRAs require your contribution before the year is up. The website Cashmoneylife has had a whole series of articles on self employed retirement options. I recommend reading them.

Wednesday, December 17, 2008

Reinvest Your Stock Dividends - Schwab vs Scottrade

I did this for two main reasons. One, with my Scottrade account I found that the money I received from dividends just went into a money market account. Most of the time the stocks I owned paid a higher yield than the money market so I felt I was leaving money on the table. The second reason I do it is that I can then see the true growth of that stock since the dividends, which are part of the overall return, are reinvested. I get a more accurate picture of the true return of that stock.

Tuesday, December 16, 2008

Want to Improve Your Finances? Measure Them

The same goes for your finances. You need to measure your spending, saving, and investing. How do you measure your finances? It's really easy now with the advent of these online money management sites like Quicken, Mint, Wesabe, and Geezeo (See my Online Money Manangement site comparison). They make it really easy. If you do business at the right banks and credit card companies it's a no brainer. They will gather all the data right for you. All you do is setup your accounts and then login to get up-to-date info. It is then a piece of cake to categorize your spending and saving. These services also provide great graphs for see visually where your money is going. If online isn't for you then do it the old fashioned way by righting down where you spend your money. Either way, you have taken the first step to improve your finances.

After you are collecting data, look at the data at least once per month. Determine how much money you are spending for each category. Spending too much on dining out? Make a mental note and adjust your spending. Until you see where your money is really going it is hard to make adjustments. Look at every expense. Can you reduce it or eliminate it? How much do you spend on car or homeowners insurance? Have you got a quote lately? You can probably find a better deal. But until you look at where your money is going you will just keep going down the wrong path. This works for savings too. If your plan is to save $100 month, are you? Do you see your savings account growing each month? It will be easy to see if you monitor your accounts.

Remember, measure your finances to improve them.

Sunday, December 14, 2008

Wesabe has a new feature - Spending Targets

Click here to see my online money management site comparisons

Friday, December 12, 2008

How to Use Credit Cards to Monitor Your Spending

First let's discuss how to use a credit card for your benefit.

- Find a card that gives you cash back. I recommend American Express Blue and Discover Card.

- Everytime you use it, realize you will pay that amount when the credit card bill comes

- Repeat of #3, don't ever carry a balance. Pay your bill in full each month.

- Take advantage of the online features of your credit card website to track where you spend your money.

I pretty much use my credit card for everything I buy. I never carry a balance from month to month. I watch my balances online so I know how much I've spent and how much I need to pay at the end of the month. I use my cash back to reduce what I owe the credit card company. I use my credit card data to see where I spend my money each month and where I need to cut back on my spending. Dining out creeping up this month? I better cut back and find something at home to eat. If I use cash I tend to lose track of where I spend the money.

Don't even get a credit card if you will do any of the following:

- Know you won't pay the balance in full every month.

- You don't realize your spending the equivalent of cash every time you use it.

- You won't go back and see where you are spending your money and make adjustments to stay within your means.

I repeat. Don't get a credit card if you won't pay it off every month. The first month you can't pay it off, cut it up.

I'm kind of the opposite of most people. If I have cash in my pocket I tend to spend it on silly stuff like frozen cokes and shakes. For some reason, it doesn't make sense for me to use a credit card on this kind of purchases so I won't buy them if I don't have cash. Most people find it hard to spend cash but easy to spend on credit. I fear not being able to cover the credit card bill at the end of the month and tend to cut back on spending.

Thursday, December 11, 2008

Fund Your 401K Then Up the Amount

Let's assume you listened to this part. Now I'm going to tell you to put in more. More? How? Well, next time you get a raise put some or all of that in your 401K. Let's say you get a $100 a month raise. Act like you didn't get a raise and put the whole $100 in your 401K. You will increase your savings in the 401K plus avoid paying income tax on the extra $100. Even if you can only put a portion in, DO IT!

Put in whatever you can, then raise that amount each year. At least put in enough to get any of your companies matching money. That's the easiest money you will ever make. Do it!

Once you get all the company matching money, then raise it again. Every year you get a raise put part of it towards your 401K until you max it out. Read your companies brochures and see how this money will grow. It's amazing. You need to do this. Social Security won't meet your needs. You need to plan for this on your own. The generations working now don't have the retirement plans our parents did. We are on our own.

After you do all this and build up that retirement money, don't take it out until you retire. Don't tap into this money to buy a house or buy a car. Don't do it! If you have to do this, then you can't afford whatever you are buying. Only take this money out before your retirement if you have pretty much used up every other avenue and you need this money to buy you food.

Wednesday, December 10, 2008

Save Money by Not Being Able to Get To It

Setting up these automated systems to help you save or spend money wisely is super easy to do. Once you get them started they just take care of themselves. Try it, REALLY!

Monday, December 8, 2008

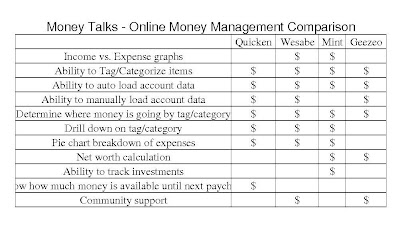

Online Money Management Sites Compared - Mint, Quicken, Wesabe and Geezeo

I have previously commented on my opinions about Mint, Quicken, and Wesabe. Since then I have tried Geezeo. Above is a table showing the functionality of each service. Click on the image to bring up a bigger, easy to read version. I have listed the features in order of importance to me. As they say, your mileage may vary depending on what you are looking for.

Setup Your Automatic Savings Plans

What should you do with this money. Well just don't let it sit there. Have it moved, of course, automatically to a good savings vehicle. I use INGdirect for my emergency funds and Schwab for my investments. I have these companies automatically move the amount I have identified as savings to my accounts at these sites. The INGdirect.com is a traditional savings account but with a higher interest rate than you will find at your bank or credit union. With the money going to Schwab I have that invested in a mutual fund for my kid's college funds. You don't need a lot of money to get started at either of these sites. Getting started with either is easy.

Again, set this all up automatically and it is just easier. Before you know it you have a nice stash.

Saturday, December 6, 2008

Organize Your Checking Accounts to Better Manage Your Money

With this method, I know the basics living expenses and my savings are covered with the money in my Fixed Checking account. I can then just concentrate my time on monitoring the money going out of the Variable Checking account. I don't pay any other bills out of my Fixed Checking account so that I don't get myself in trouble meeting those expenses. You have to monitor your Fixed Checking account every few months to make sure one of the expenses didn't go up or down and adjust your direct deposits accordingly. If one of the expenses would go down, I then add that money to my savings amount each month. This really helps me to keep an eye on my discretionary expenses. Once you get it all setup it's really easy to keep going. Try it!

Thursday, December 4, 2008

My Dollar Plan Website

Wednesday, December 3, 2008

Off Topic - Photo Question

Tuesday, December 2, 2008

Quicken Online has improved!

I am still using Wesabe for the time being. I really like the income versus expenses graph. Wesabe gives you that on the front page. Between that and a little more flexible tagging or categorizing is why I still like Wesabe better. I can get all my accounts updated fairly easily (still not as easy as Quicken). Mint.com still can't upload my credit union data. Until I can do that this site will not work.

Still the winner: Wesabe

Are you cutting back on your Christmas presents this year?

Monday, December 1, 2008

Dick Davis Digest Newsletter Review

Saturday, November 29, 2008

The Simple Living Network Website

New Retirement Mentality Website

I read an article in the newspaper today about a new way to look at retirement. It referenced a website called newretirementmentality.com . This website is advertising a new book coming out but it has an interesting activity that will help you with life planning and retirement. It asks you what your thoughts are for retirement. This is an important step to actually think about what your are going to do and not just fantasize about the future. Then it asks you how much time you spend on things currently and what your ideal breakdown would be. It then asks you some questions about your work life and scores your answers. When its all done it creates a pdf file with all your answers and encourages you to think more about your plan. I like the printout. It forced me to think a little more about what I plan for the future not just someday quitting my job.

Friday, November 28, 2008

Your Money or Your Life - book review

I think they are releasing a revised version in December of 2008. I would probably wait to get that version unless the library has a copy of the older version that you can read for free.

You can also see more about this book on my Squidoo page.

Online money management sites

My Pick: Wesabe