One thing I have learned in the business world is if you want to improve something, measure it. Whether its widgets made per hour or agent time spent on the phone. If you measure it, it will improve.

The same goes for your finances. You need to measure your spending, saving, and investing. How do you measure your finances? It's really easy now with the advent of these online money management sites like Quicken, Mint, Wesabe, and Geezeo (See my Online Money Manangement site comparison). They make it really easy. If you do business at the right banks and credit card companies it's a no brainer. They will gather all the data right for you. All you do is setup your accounts and then login to get up-to-date info. It is then a piece of cake to categorize your spending and saving. These services also provide great graphs for see visually where your money is going. If online isn't for you then do it the old fashioned way by righting down where you spend your money. Either way, you have taken the first step to improve your finances.

After you are collecting data, look at the data at least once per month. Determine how much money you are spending for each category. Spending too much on dining out? Make a mental note and adjust your spending. Until you see where your money is really going it is hard to make adjustments. Look at every expense. Can you reduce it or eliminate it? How much do you spend on car or homeowners insurance? Have you got a quote lately? You can probably find a better deal. But until you look at where your money is going you will just keep going down the wrong path. This works for savings too. If your plan is to save $100 month, are you? Do you see your savings account growing each month? It will be easy to see if you monitor your accounts.

Remember, measure your finances to improve them.

Showing posts with label mint. Show all posts

Showing posts with label mint. Show all posts

Tuesday, December 16, 2008

Monday, December 8, 2008

Online Money Management Sites Compared - Mint, Quicken, Wesabe and Geezeo

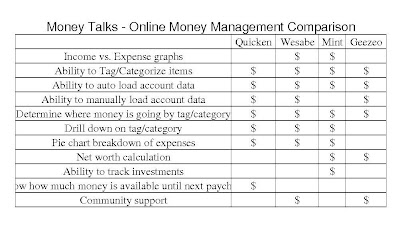

I have previously commented on my opinions about Mint, Quicken, and Wesabe. Since then I have tried Geezeo. Above is a table showing the functionality of each service. Click on the image to bring up a bigger, easy to read version. I have listed the features in order of importance to me. As they say, your mileage may vary depending on what you are looking for.

Currently Geezeo has limited functionality as far as graphically showing you how you are doing. They do have a method of getting any account added since they support both an automatic and a manual entry method. They also have community that helps support its users through discussions and common goal sharing. The one annoyance I had with the website is the abundance of adds. I understand they are trying to help pay for the free service but it overwhelms the usefulness.

All in all, I'm still using Wesabe for my money management. It gives me what I want in easy to read graphs and a powerful tagging and reporting capability.

Tuesday, December 2, 2008

Quicken Online has improved!

Quicken Online has improved their free online offering since I last wrote about it. In my earlier post I compared Mint.com, Quicken Online and Wesabe. I noticed this weekend that Quicken Online has made some changes. It seems to add a few new minor options but the biggest option is they do a calculation of how much money you have available until your next paycheck. They base this on the previous months payments and paydays. It's really pretty accurate. This is a nice feature, but I believe it just encourages spending. By knowing how much you have left to spend by the next paycheck, I look at that like okay I have $50 that I can spend. It should be looked at like I have $50 to save or invest but I don't. It looks ahead and takes into account future repeatable expenses that are coming up before your payday so it should help you not overspend. I think the service is nice but I just look at it wrong. The one thing I can't do that I really rely on is to compare my expense to my earnings for the month. I look at that every month and then determine how much, if any, I can move to savings. I looked all over the web page but couldn't figure out how to get a graph, chart or listing that shows how much I made versus how much I spent. Quicken Online is still the easiest site to get your data imported from your accounts automatically. I set it up the first time and now everytime I login it automatically updates all my accounts without me doing a thing. That is nice.

I am still using Wesabe for the time being. I really like the income versus expenses graph. Wesabe gives you that on the front page. Between that and a little more flexible tagging or categorizing is why I still like Wesabe better. I can get all my accounts updated fairly easily (still not as easy as Quicken). Mint.com still can't upload my credit union data. Until I can do that this site will not work.

Still the winner: Wesabe

I am still using Wesabe for the time being. I really like the income versus expenses graph. Wesabe gives you that on the front page. Between that and a little more flexible tagging or categorizing is why I still like Wesabe better. I can get all my accounts updated fairly easily (still not as easy as Quicken). Mint.com still can't upload my credit union data. Until I can do that this site will not work.

Still the winner: Wesabe

Friday, November 28, 2008

Online money management sites

I have been looking for a good site to manage my savings. I have tried Mint.com, Quicken Online, and Wesabe. Quicken online had the most connections with different financial institutions to make downloading your data very easy. The problem was that the reporting and the ability to analyze your data were very poor. Mint had the best web site and neatest graphs. They also have a unique idea of offering outside vendors products (like low interest credit cards or cash back offers) that could save you money. They recommended that I look at an American Express Blue card for cash back. I signed up for the American Express card since it looks like it will give me more cash back and there is no annual fee. The problem I had with Mint was that I couldn't get my data from my Credit union accounts. My checking accounts, along with Bill Payment, is all with Credit unions. I couldn't get that data input into Mint. Without that data it's useless. I'll keep monitoring it to see if they make a way to enter my data. The site I liked the best was Wesabe. I didn't at first. It seemed a little less flashy than the other sites, but don't let that fool you. They have a method to get the data from all your financial institutions either automatically, manually or through a slick little add-on for Firefox web browsers (although I question whether this is secure enough). The thing that didn't jump out at me at first was the use of tagging. Start tagging your expenses and income and things start to happen. It will automatically start tagging all transactions from that vendor. Then everytime this expense comes in it automatically gets tagged. Now use those tags to start seeing how you are spending your money. How much do I spend on Utilities? How about Electric Utilities. It's really powerful.

My Pick: Wesabe

My Pick: Wesabe

Subscribe to:

Posts (Atom)