Here is the reason I use the American Express Blue Cash Back Card.

+No Annual fee

+Up to 5% cashback on everyday purchases and 1.5% on everything else (see details below)

+0% interest on first 12 months of purchases (don't plan on taking advantage of this)

+Earn unlimited rewards

+Purchase Protection

+Extended Warranty

Blue Cash from American Express has 1 percent cash back on everyday purchases until you spend $6,500. After that, your rebate jumps to 5 percent cash back. On other purchases, 0.5 percent cash back goes up to 1.5 percent cash back. There are no cap limits on your purchases over the year. You can only get your cash back once every year and it they will only give you the cash back in the form of statement credit. The nice part is they put the credit on your account automatically after your year of use. No call, no worries.

Showing posts with label money. Show all posts

Showing posts with label money. Show all posts

Tuesday, December 30, 2008

Sunday, December 14, 2008

Wesabe has a new feature - Spending Targets

Wesabe has added a new feature that I really like. It's called Spending Targets. You can pick up to 5 categories/tags to monitor. After you pick these tags you then put in a target amount that you want to spend or budget for the month. It then shows you how you are doing as the month progresses. I use this to keep track of some of the more variable expenses we have each month like clothing or other non-essential expenses. As I have said in earlier posts I pay all my fixed expenses like utilities from a separate checking account and fund that with direct deposit. I then pay all my variable expenses out of another account. I then just watch my spending on these items to determine whether I will spend less than I make. This is the key! To spend less than you make.

Click here to see my online money management site comparisons

Click here to see my online money management site comparisons

Monday, December 8, 2008

Online Money Management Sites Compared - Mint, Quicken, Wesabe and Geezeo

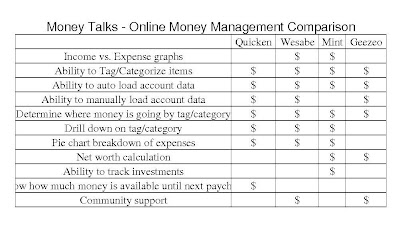

I have previously commented on my opinions about Mint, Quicken, and Wesabe. Since then I have tried Geezeo. Above is a table showing the functionality of each service. Click on the image to bring up a bigger, easy to read version. I have listed the features in order of importance to me. As they say, your mileage may vary depending on what you are looking for.

Currently Geezeo has limited functionality as far as graphically showing you how you are doing. They do have a method of getting any account added since they support both an automatic and a manual entry method. They also have community that helps support its users through discussions and common goal sharing. The one annoyance I had with the website is the abundance of adds. I understand they are trying to help pay for the free service but it overwhelms the usefulness.

All in all, I'm still using Wesabe for my money management. It gives me what I want in easy to read graphs and a powerful tagging and reporting capability.

Setup Your Automatic Savings Plans

In an earlier article I talked about how to set up your checking accounts to put your financial life on auto pilot. One of the things I do is automatically have my savings taken out of one of my checking accounts that I put all my monthly fixed expenses. I make my savings become a fixed expense just like my utility bills or mortgage. I pay myself first which is a method that I'm sure you have heard a hundred times. By doing this all automatically it becomes less painful and gets "lost" in all the other expenses. This getting "lost" is good because you tend to forget that you are saving this money.

What should you do with this money. Well just don't let it sit there. Have it moved, of course, automatically to a good savings vehicle. I use INGdirect for my emergency funds and Schwab for my investments. I have these companies automatically move the amount I have identified as savings to my accounts at these sites. The INGdirect.com is a traditional savings account but with a higher interest rate than you will find at your bank or credit union. With the money going to Schwab I have that invested in a mutual fund for my kid's college funds. You don't need a lot of money to get started at either of these sites. Getting started with either is easy.

Again, set this all up automatically and it is just easier. Before you know it you have a nice stash.

What should you do with this money. Well just don't let it sit there. Have it moved, of course, automatically to a good savings vehicle. I use INGdirect for my emergency funds and Schwab for my investments. I have these companies automatically move the amount I have identified as savings to my accounts at these sites. The INGdirect.com is a traditional savings account but with a higher interest rate than you will find at your bank or credit union. With the money going to Schwab I have that invested in a mutual fund for my kid's college funds. You don't need a lot of money to get started at either of these sites. Getting started with either is easy.

Again, set this all up automatically and it is just easier. Before you know it you have a nice stash.

Labels:

automatic savings,

bank,

budgeting,

financial,

money,

money management,

personal finance

Saturday, December 6, 2008

Organize Your Checking Accounts to Better Manage Your Money

Here is how I organize my checking accounts to separate my fixed expenses and my discretionary expenses. I have 2 checking accounts, one I'll call the Fixed Checking account and one I'll call the Variable Checking account. I then setup certain bills to be automatically paid out of my Fixed Checking account. I hate to write checks and since these expenses are pretty much non-negotiable I have them take out the money automatically. In the Fixed Checking account I pay expenses like the mortgage, electric bill, gas bill, telephone bill, car loan payment, etc. I put all the utilities on budget billing so the amount is basically the same all year. I also add one important thing to this account. I also add to the Fixed Checking account my savings for each month. I add an expense for my kids college savings and our personal savings. I have my brokerage then take these amounts out each month and invest them automatically. I then add up all these fixed expenses and have my employer, using direct deposit, put an amount in my Fixed Checking account every payday to cover these expenses for the month. I then have the rest of paycheck put in my Variable Checking account. From the Variable Checking account I pay things that are less important and for unpredictable amounts, like credit cards, dance classes for my daughter, vacations, etc. If we don't have the money in the Variable Checking account to cover the expense, we can't afford it.

With this method, I know the basics living expenses and my savings are covered with the money in my Fixed Checking account. I can then just concentrate my time on monitoring the money going out of the Variable Checking account. I don't pay any other bills out of my Fixed Checking account so that I don't get myself in trouble meeting those expenses. You have to monitor your Fixed Checking account every few months to make sure one of the expenses didn't go up or down and adjust your direct deposits accordingly. If one of the expenses would go down, I then add that money to my savings amount each month. This really helps me to keep an eye on my discretionary expenses. Once you get it all setup it's really easy to keep going. Try it!

With this method, I know the basics living expenses and my savings are covered with the money in my Fixed Checking account. I can then just concentrate my time on monitoring the money going out of the Variable Checking account. I don't pay any other bills out of my Fixed Checking account so that I don't get myself in trouble meeting those expenses. You have to monitor your Fixed Checking account every few months to make sure one of the expenses didn't go up or down and adjust your direct deposits accordingly. If one of the expenses would go down, I then add that money to my savings amount each month. This really helps me to keep an eye on my discretionary expenses. Once you get it all setup it's really easy to keep going. Try it!

Labels:

bank,

budgeting,

financial,

money,

money management,

personal finance

Thursday, December 4, 2008

My Dollar Plan Website

My Dollar Plan is my favorite site for learning ways to save, make, and conserve money. Madison DuPaix made a calculated move to quit her job. It was a bold move but has worked out well for her. Read her story and you'll see that this was a well thought out plan. She is a real numbers person. She has some very ingenious ways to stretch a buck. One thing she does that is not conventional, but effective, is what she calls credit card arbitrage. She looks for credit cards that offer free interest for credit transfers and new purchases. She then puts the money she would have spent in an interest bearing account and pockets the interest. She has a intricate method of tracking all these credit cards and keeps moving them so she never has to pay interest. You need to read her plan to even consider it. Miss one transfer date and you'll pay more in interest to the credit card company than you will make in a savings account. She covers just about any topic from Insurance to IRA's to college savings. I have her on my daily read list. I never miss a post. I have picked up several items that she has written about to save me money or look for a better deal.

Labels:

budgeting,

credit cards,

debt,

investing,

money,

my dollar plan,

savings,

websites

Tuesday, December 2, 2008

Quicken Online has improved!

Quicken Online has improved their free online offering since I last wrote about it. In my earlier post I compared Mint.com, Quicken Online and Wesabe. I noticed this weekend that Quicken Online has made some changes. It seems to add a few new minor options but the biggest option is they do a calculation of how much money you have available until your next paycheck. They base this on the previous months payments and paydays. It's really pretty accurate. This is a nice feature, but I believe it just encourages spending. By knowing how much you have left to spend by the next paycheck, I look at that like okay I have $50 that I can spend. It should be looked at like I have $50 to save or invest but I don't. It looks ahead and takes into account future repeatable expenses that are coming up before your payday so it should help you not overspend. I think the service is nice but I just look at it wrong. The one thing I can't do that I really rely on is to compare my expense to my earnings for the month. I look at that every month and then determine how much, if any, I can move to savings. I looked all over the web page but couldn't figure out how to get a graph, chart or listing that shows how much I made versus how much I spent. Quicken Online is still the easiest site to get your data imported from your accounts automatically. I set it up the first time and now everytime I login it automatically updates all my accounts without me doing a thing. That is nice.

I am still using Wesabe for the time being. I really like the income versus expenses graph. Wesabe gives you that on the front page. Between that and a little more flexible tagging or categorizing is why I still like Wesabe better. I can get all my accounts updated fairly easily (still not as easy as Quicken). Mint.com still can't upload my credit union data. Until I can do that this site will not work.

Still the winner: Wesabe

I am still using Wesabe for the time being. I really like the income versus expenses graph. Wesabe gives you that on the front page. Between that and a little more flexible tagging or categorizing is why I still like Wesabe better. I can get all my accounts updated fairly easily (still not as easy as Quicken). Mint.com still can't upload my credit union data. Until I can do that this site will not work.

Still the winner: Wesabe

Monday, December 1, 2008

Dick Davis Digest Newsletter Review

I have subscribed to the Dick Davis Digest newsletter for the last few years. The newsletter is a culmination of all the other newsletters. They get one or two stock selections and write ups from all the different newsletters. They publish these along with all the others. They probably have 20-30 stock recommendations in every newsletter. The newsletter is published every two weeks and is mailed to your home. Their online offerings are pretty slim. The write ups are usually pretty short and concise which coincides with my theory on picking stocks. If you can't explain in about 4 sentences why you own the stock then you probably shouldn't own it. I have made some very good stock purchases over the years based on recommendations from this newsletter. The other advantage of this newsletter is that you start to learn which other newsletters have the best selections or conform to your stock picking methodology. This way you can "try before you buy" the other usually more costly newsletter. I highly recommend this service.

Saturday, November 29, 2008

The Simple Living Network Website

The Simple Living Network is an admirable website. It preaches minimalist living to persuade you to live modestly but happily. While I really buy into the idea I don't think I'm ready to totally commit to that life style. I absolutely believe in spending your money where it will give you the most fulfillment. You really need to determine where that is and then adjust your spending to match your desires. The key is figuring out where all your money is currently going and then adjust your spending and your thoughts accordingly. This site has some great ideas on how to spend your money and be more eco-friendly.

New Retirement Mentality Website

I read an article in the newspaper today about a new way to look at retirement. It referenced a website called newretirementmentality.com . This website is advertising a new book coming out but it has an interesting activity that will help you with life planning and retirement. It asks you what your thoughts are for retirement. This is an important step to actually think about what your are going to do and not just fantasize about the future. Then it asks you how much time you spend on things currently and what your ideal breakdown would be. It then asks you some questions about your work life and scores your answers. When its all done it creates a pdf file with all your answers and encourages you to think more about your plan. I like the printout. It forced me to think a little more about what I plan for the future not just someday quitting my job.

Friday, November 28, 2008

Your Money or Your Life - book review

I just finished a book called "Your Money or Your Life" by Joe Dominguez (Author), Vicki Robin (Author). This book was published in 1993 so its a little out dated. The main concept is not, though. Instead of making budgets that you hate to do and don't follow. It tells you to track your expenses and see where the money is going. Then look at those expenses compared to your goals and needs. By looking at this each month, you start to adjust how you spend your money so that your spending starts lining up with your goals and desires. It gets you off that cycle of spending money on stupid stuff. It has you create tables and graphs to see where your money is going and how you are doing in spending less than you make. This tracking the results in crucial since things that are measured always improve. Then once you get your spending in order it then talks about setting up investments in US Treasury bonds to earn a guaranteed income. Through the marvel of compound interest you can eventually earn enough money through your bonds to quit working. I did a quick calculation based on the current Treasury rate, 4%, and I could maybe have enough money from my bonds to cover my expenses in 20 years. Pretty reasonable amount of time, but it seems like forever for a disciple of the immediate gratification generation. I recommend the book.

I think they are releasing a revised version in December of 2008. I would probably wait to get that version unless the library has a copy of the older version that you can read for free.

You can also see more about this book on my Squidoo page.

I think they are releasing a revised version in December of 2008. I would probably wait to get that version unless the library has a copy of the older version that you can read for free.

You can also see more about this book on my Squidoo page.

Online money management sites

I have been looking for a good site to manage my savings. I have tried Mint.com, Quicken Online, and Wesabe. Quicken online had the most connections with different financial institutions to make downloading your data very easy. The problem was that the reporting and the ability to analyze your data were very poor. Mint had the best web site and neatest graphs. They also have a unique idea of offering outside vendors products (like low interest credit cards or cash back offers) that could save you money. They recommended that I look at an American Express Blue card for cash back. I signed up for the American Express card since it looks like it will give me more cash back and there is no annual fee. The problem I had with Mint was that I couldn't get my data from my Credit union accounts. My checking accounts, along with Bill Payment, is all with Credit unions. I couldn't get that data input into Mint. Without that data it's useless. I'll keep monitoring it to see if they make a way to enter my data. The site I liked the best was Wesabe. I didn't at first. It seemed a little less flashy than the other sites, but don't let that fool you. They have a method to get the data from all your financial institutions either automatically, manually or through a slick little add-on for Firefox web browsers (although I question whether this is secure enough). The thing that didn't jump out at me at first was the use of tagging. Start tagging your expenses and income and things start to happen. It will automatically start tagging all transactions from that vendor. Then everytime this expense comes in it automatically gets tagged. Now use those tags to start seeing how you are spending your money. How much do I spend on Utilities? How about Electric Utilities. It's really powerful.

My Pick: Wesabe

My Pick: Wesabe

Subscribe to:

Posts (Atom)