One thing I have learned in the business world is if you want to improve something, measure it. Whether its widgets made per hour or agent time spent on the phone. If you measure it, it will improve.

The same goes for your finances. You need to measure your spending, saving, and investing. How do you measure your finances? It's really easy now with the advent of these online money management sites like Quicken, Mint, Wesabe, and Geezeo (See my Online Money Manangement site comparison). They make it really easy. If you do business at the right banks and credit card companies it's a no brainer. They will gather all the data right for you. All you do is setup your accounts and then login to get up-to-date info. It is then a piece of cake to categorize your spending and saving. These services also provide great graphs for see visually where your money is going. If online isn't for you then do it the old fashioned way by righting down where you spend your money. Either way, you have taken the first step to improve your finances.

After you are collecting data, look at the data at least once per month. Determine how much money you are spending for each category. Spending too much on dining out? Make a mental note and adjust your spending. Until you see where your money is really going it is hard to make adjustments. Look at every expense. Can you reduce it or eliminate it? How much do you spend on car or homeowners insurance? Have you got a quote lately? You can probably find a better deal. But until you look at where your money is going you will just keep going down the wrong path. This works for savings too. If your plan is to save $100 month, are you? Do you see your savings account growing each month? It will be easy to see if you monitor your accounts.

Remember, measure your finances to improve them.

Showing posts with label money management. Show all posts

Showing posts with label money management. Show all posts

Tuesday, December 16, 2008

Sunday, December 14, 2008

Wesabe has a new feature - Spending Targets

Wesabe has added a new feature that I really like. It's called Spending Targets. You can pick up to 5 categories/tags to monitor. After you pick these tags you then put in a target amount that you want to spend or budget for the month. It then shows you how you are doing as the month progresses. I use this to keep track of some of the more variable expenses we have each month like clothing or other non-essential expenses. As I have said in earlier posts I pay all my fixed expenses like utilities from a separate checking account and fund that with direct deposit. I then pay all my variable expenses out of another account. I then just watch my spending on these items to determine whether I will spend less than I make. This is the key! To spend less than you make.

Click here to see my online money management site comparisons

Click here to see my online money management site comparisons

Monday, December 8, 2008

Online Money Management Sites Compared - Mint, Quicken, Wesabe and Geezeo

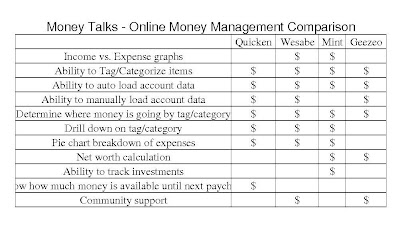

I have previously commented on my opinions about Mint, Quicken, and Wesabe. Since then I have tried Geezeo. Above is a table showing the functionality of each service. Click on the image to bring up a bigger, easy to read version. I have listed the features in order of importance to me. As they say, your mileage may vary depending on what you are looking for.

Currently Geezeo has limited functionality as far as graphically showing you how you are doing. They do have a method of getting any account added since they support both an automatic and a manual entry method. They also have community that helps support its users through discussions and common goal sharing. The one annoyance I had with the website is the abundance of adds. I understand they are trying to help pay for the free service but it overwhelms the usefulness.

All in all, I'm still using Wesabe for my money management. It gives me what I want in easy to read graphs and a powerful tagging and reporting capability.

Setup Your Automatic Savings Plans

In an earlier article I talked about how to set up your checking accounts to put your financial life on auto pilot. One of the things I do is automatically have my savings taken out of one of my checking accounts that I put all my monthly fixed expenses. I make my savings become a fixed expense just like my utility bills or mortgage. I pay myself first which is a method that I'm sure you have heard a hundred times. By doing this all automatically it becomes less painful and gets "lost" in all the other expenses. This getting "lost" is good because you tend to forget that you are saving this money.

What should you do with this money. Well just don't let it sit there. Have it moved, of course, automatically to a good savings vehicle. I use INGdirect for my emergency funds and Schwab for my investments. I have these companies automatically move the amount I have identified as savings to my accounts at these sites. The INGdirect.com is a traditional savings account but with a higher interest rate than you will find at your bank or credit union. With the money going to Schwab I have that invested in a mutual fund for my kid's college funds. You don't need a lot of money to get started at either of these sites. Getting started with either is easy.

Again, set this all up automatically and it is just easier. Before you know it you have a nice stash.

What should you do with this money. Well just don't let it sit there. Have it moved, of course, automatically to a good savings vehicle. I use INGdirect for my emergency funds and Schwab for my investments. I have these companies automatically move the amount I have identified as savings to my accounts at these sites. The INGdirect.com is a traditional savings account but with a higher interest rate than you will find at your bank or credit union. With the money going to Schwab I have that invested in a mutual fund for my kid's college funds. You don't need a lot of money to get started at either of these sites. Getting started with either is easy.

Again, set this all up automatically and it is just easier. Before you know it you have a nice stash.

Labels:

automatic savings,

bank,

budgeting,

financial,

money,

money management,

personal finance

Saturday, December 6, 2008

Organize Your Checking Accounts to Better Manage Your Money

Here is how I organize my checking accounts to separate my fixed expenses and my discretionary expenses. I have 2 checking accounts, one I'll call the Fixed Checking account and one I'll call the Variable Checking account. I then setup certain bills to be automatically paid out of my Fixed Checking account. I hate to write checks and since these expenses are pretty much non-negotiable I have them take out the money automatically. In the Fixed Checking account I pay expenses like the mortgage, electric bill, gas bill, telephone bill, car loan payment, etc. I put all the utilities on budget billing so the amount is basically the same all year. I also add one important thing to this account. I also add to the Fixed Checking account my savings for each month. I add an expense for my kids college savings and our personal savings. I have my brokerage then take these amounts out each month and invest them automatically. I then add up all these fixed expenses and have my employer, using direct deposit, put an amount in my Fixed Checking account every payday to cover these expenses for the month. I then have the rest of paycheck put in my Variable Checking account. From the Variable Checking account I pay things that are less important and for unpredictable amounts, like credit cards, dance classes for my daughter, vacations, etc. If we don't have the money in the Variable Checking account to cover the expense, we can't afford it.

With this method, I know the basics living expenses and my savings are covered with the money in my Fixed Checking account. I can then just concentrate my time on monitoring the money going out of the Variable Checking account. I don't pay any other bills out of my Fixed Checking account so that I don't get myself in trouble meeting those expenses. You have to monitor your Fixed Checking account every few months to make sure one of the expenses didn't go up or down and adjust your direct deposits accordingly. If one of the expenses would go down, I then add that money to my savings amount each month. This really helps me to keep an eye on my discretionary expenses. Once you get it all setup it's really easy to keep going. Try it!

With this method, I know the basics living expenses and my savings are covered with the money in my Fixed Checking account. I can then just concentrate my time on monitoring the money going out of the Variable Checking account. I don't pay any other bills out of my Fixed Checking account so that I don't get myself in trouble meeting those expenses. You have to monitor your Fixed Checking account every few months to make sure one of the expenses didn't go up or down and adjust your direct deposits accordingly. If one of the expenses would go down, I then add that money to my savings amount each month. This really helps me to keep an eye on my discretionary expenses. Once you get it all setup it's really easy to keep going. Try it!

Labels:

bank,

budgeting,

financial,

money,

money management,

personal finance

Subscribe to:

Posts (Atom)